The anatomy of “small scale” purchases – the Czech case

In our previous article, we established that the vast majority of government purchases are not regulated by the EU directive but can be regulated on a national level. When it comes to the risk of corruption or wasting money, national legislation should, therefore, play a key role. But does it? Let’s take a look at Czechia (the Czech Republic), and dig a bit deeper into the anatomy of its spending.

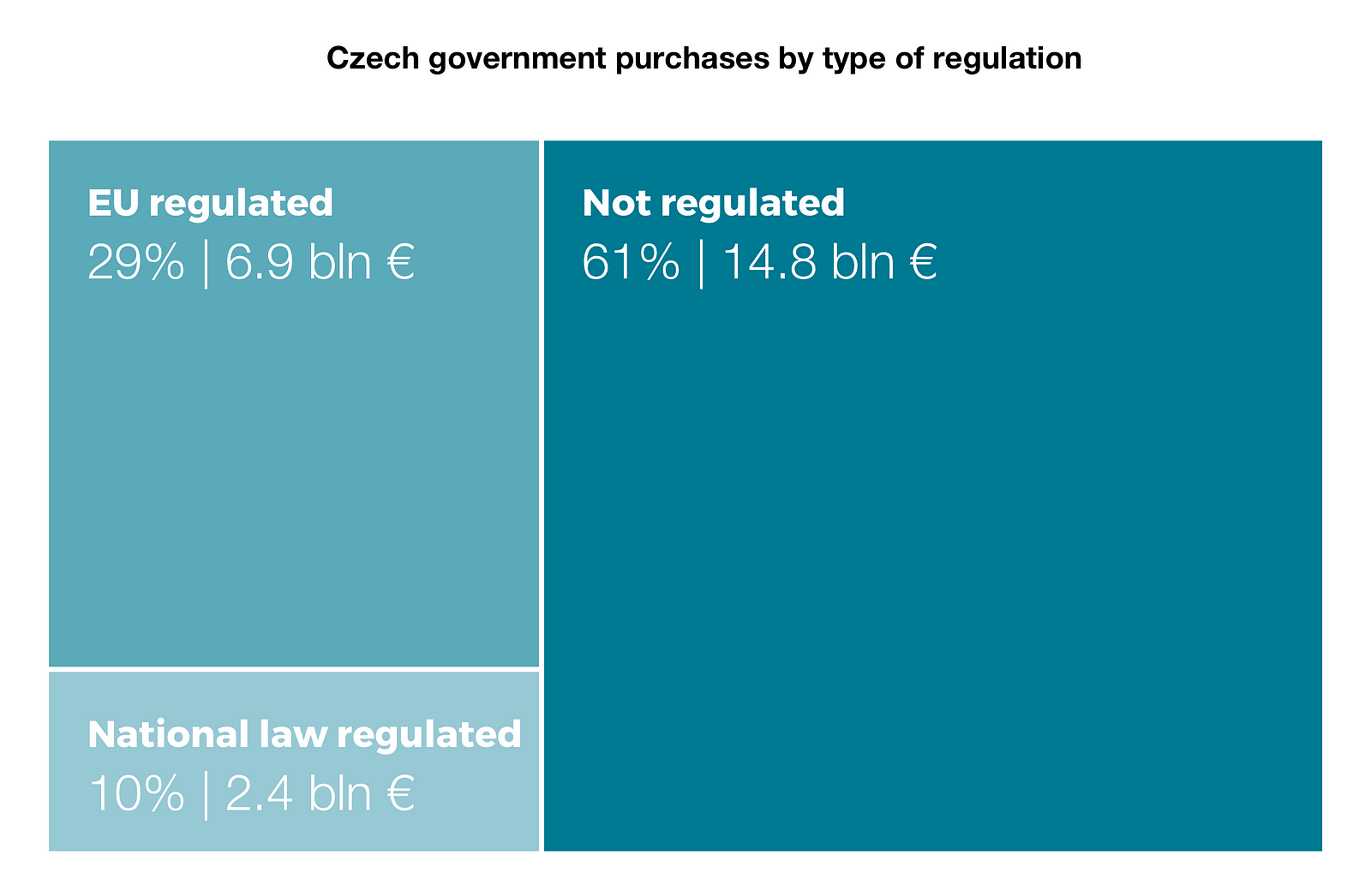

Using more precise national statistics [1] we confirmed the European Commission’s earlier estimate that 29% of Czech government spending rises above EU thresholds and is thus regulated by the EU directive. Besides this, we also calculated the volume of tenders regulated by national legislation, arriving at this:

In other words, 61% of purchases by the Czech government and its municipalities did not follow procurement regulation — either they were deemed too small or fulfilled any number of other exceptions. Let’s take a look precisely where this is happening.

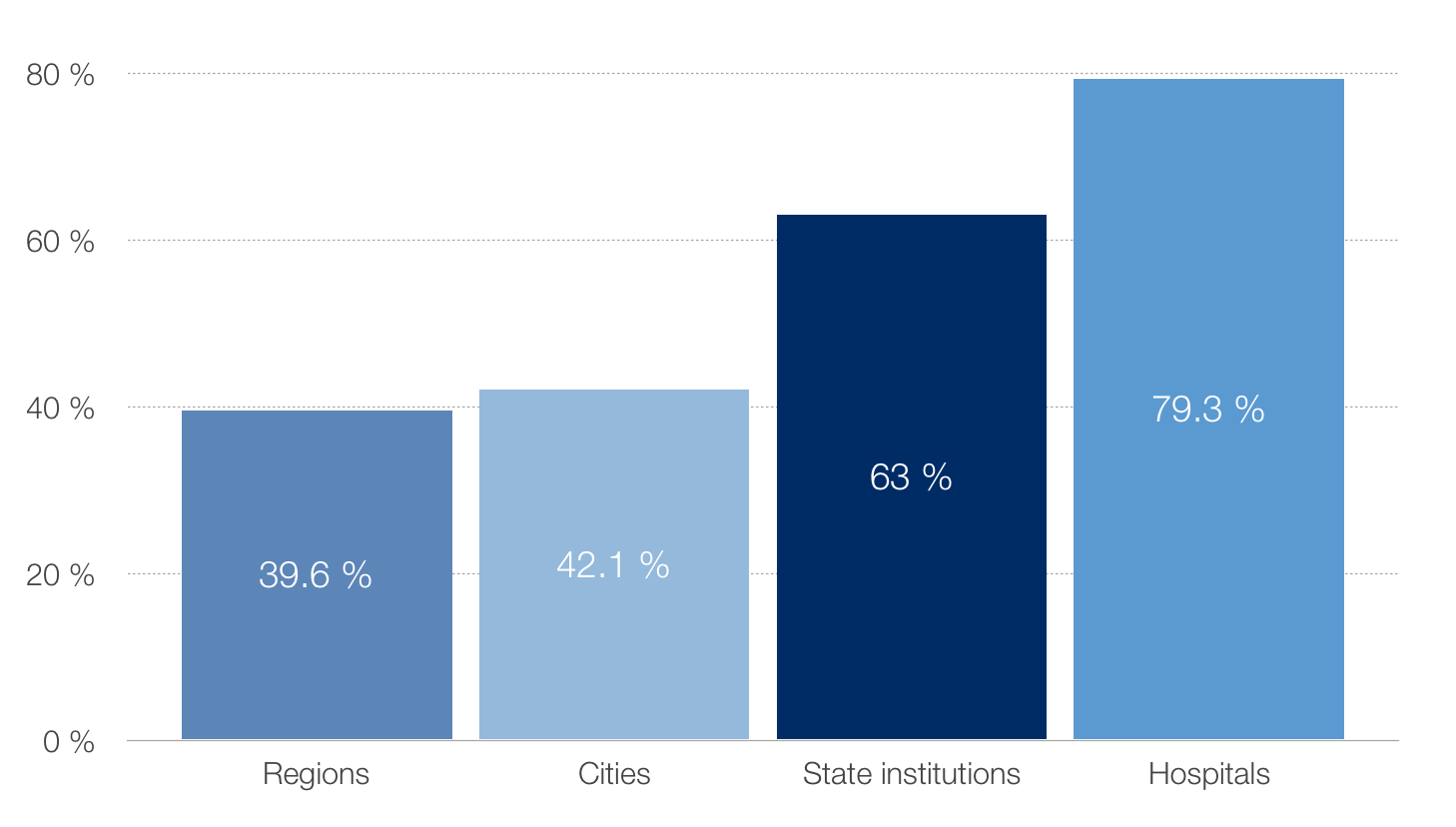

In our project zIndex.cz, for benchmarking Czech public authorities, we took accounting data for each city, ministry, and region in the country and cross-referenced them with the volume of public tenders. First, we confirmed previous estimates: the average authority indeed makes 2/3 of its purchases outside of procurement.

The closer detail was however much more surprising. Whereas one would expect small authorities with lots of little spending to be the leaders in purchases under the legal thresholds, the result came close to the opposite. It is the major state institutions and state-owned enterprises such as hospitals, that are somehow managing to make the most exceptions.One of the worst cities is our capital Prague, with only 11% of spending going through public procurement (see the full zIndex ranking of Prague). We can summarize our results as follows:

All in all, we found out that relatively narrow groups of authorities tend to have great spending outside the law. Could this be a measurement error? Or is there some rational explanation why these institutions spend huge sums of money? We dug even deeper to find out.

The case of the Czech government

When we participated in the audit of several Czech ministries and their organizations, we came up with an idea of how to investigate this spending outside public procurement. We proposed to cross-reference their invoices with our procurement database. This approach flagged a list of invoices, for which we saw no prior public procurement explaining the invoiced volume. Was this bypassing the law?

Our auditors followed up and asked ministries about the invoices, which gave us a brand new perspective on the 63% which our government spends outside public procurement: the majority of dubious invoices followed from old contracts, signed before 2006 when the registry of acquisition came into effect. In fact, most of the contracts were signed in the 90s, which was surprising given that they were based on IT or PR services. Even though the industries evolved massively, ministries saw no need to re-run the tenders and were happy to receive services from original suppliers, amending their contract multiple times. Here’s a summary of other findings below.

Investigation of invoices potentially bypassing national and EU laws:

- 20% — Clarified (central purchases, data errors)

- 61% — Old contracts

- 12% — Exceptions (national security)

- 4.5% — Below national threshold

- 2.4% — Unclear

It is our opinion that old contract amendments have not been in line with procurement law. Our audit however ended solely with a recommendation to terminate these contracts. The finding itself that multiple ministries have kept “dinosaur” contracts has shed some light on the issue of figuring out where this money goes.

The case of Czech and Slovak hospitals

In Czechia and Slovakia, we have an amazing transparency tool called the Registry of Contracts. Inside or outside public procurement, any contract signed by a public authority legally must be published in this online database. So we went to this registry to find out what makes up this 80% of hospital spending, that for some reason cannot go through public procurement.

As we expected, it was the small contracts. We found tens of thousands of contracts valued at up to 75 000 EUR (the national threshold), typically for ordering drugs and medical supplies. However, at closer inspection, we found that a disturbing number of them went to a small number of companies, including a few Czech shell companies but also branches of multinational corporates such as Phoenix, Walgreens Boots Alliance or Boston Scientific Group. The contract volumes were way above any national or EU threshold, counting in millions of euros and all awarded directly without competition as “below threshold” contracts.

After our government representatives assured us this is in line with Czech law (as these are many small purchases), we filed a question with the European Commission. Finally, this resulted in the commission mandating the Czech government to change the law accordingly. Despite this now being three months ago, we are still waiting for the change to occur :).

“Authorities better ranked by zIndex save 5% in each tender.”

What can we learn from the Czech case?

So, what is the 61% of Czech purchases unregulated by any procurement law? The surprising answer is that only a fraction is actual below threshold contracts. In our zIndex rating, some hospitals managed to spend 50% of money through public procurement, some cities even 80% (that’s 30% above average in both groups). If the authorities are willing to use competitive procedures and not avoid the law, they can easily end up spending the majority of the money through public procurement — with higher transparency and potential savings. That’s what also our results suggest — in [2] we document that authorities better ranked by zIndex save 5% in each tender.

Is the practice similar in other countries? We soon hope to find out. In our project DIGIWHIST with the University of Cambridge, we are processing national procurement databases across Europe and soon we will be able to deliver some results for those countries as well.

Sources:

[1] Annual Report on Public Procurement 2015 (Czech)

[2] zIndex — Benchmarking Municipalities in Public Procurement, Skuhrovec Soudek 2016