What can OCDS data tell you? Tips for analyzing market competition and other key aspects of procurement

In this first post of our data use series OCDS tips & tricks, we explore some common checks for analyzing market competition and other key aspects of procurement, useful questions you can answer with OCDS data and what data fields you would need to answer them.

From monitoring cost overruns, comparing medicine prices to measuring efficiency and competition, the list of topics you can research with Open Contracting Data Standard (OCDS) data is long. There are more than 500 fields and data extensions available in the Open Contracting Data Standard, but in practice, publishers only release some of them depending on the data availability in their procurement systems.

The availability and quality of data will determine what insights you can generate. So to help you get started, here are some usability checks you can do before you begin your calculations and common questions that OCDS data can help answer:

First, check the coverage and quality of the data

Before starting your analysis it is important to check which fields are being published and which stages of the contracting process they belong to. This will give you context and determine what questions or conclusions you can derive from your analysis. For instance, if you are interested in studying delays in the contract delivery you will need data fields from the implementation stage.

Also, check how well-populated the fields are. This means checking how many observations are recorded and their values. For example, if the field tender/procuringEntity is published, check how many institutions are in the dataset and the proportion and quantity of contracting procedures for each. If there is only information for a few entities, then your analysis will focus on those and not on the whole procurement market.

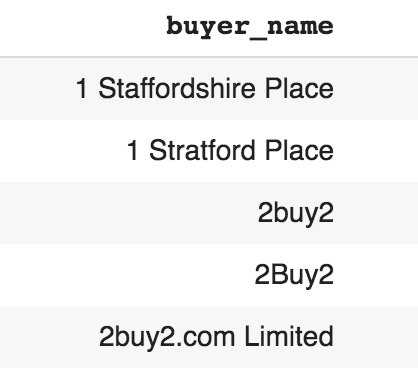

Finally, check if the fields have errors or inconsistent values. For instance, one of the most common errors we have seen is typos in the names of suppliers and procuring entities, meaning the same organization is written in different ways. In these cases, it is better to use the identifier field, if available. Other common errors you can look for are suspicious tender or award values (close to zero or a very high value), end dates before start dates or suspicious dates (e.g. 1905, 1900).

Example of typo errors

What other fields can you check for coverage?

- status, to identify how many tenders (or awards) are active, completed or canceled.

- startDate, to check the time period of the data and what years are covered.

- procurementMethod, to see if procedures are open, direct, limited, etc.

In general, check for the fields relevant to the questions you want to answer.

Example: Questions about competition and suppliers

Once you have checked the quality and coverage of your data you can start to dig deeper. Market competition is one of the most relevant topics to explore in procurement data. Better value for money can be achieved by having more intense and fairer competition. Some of the most common questions about competition include:

What is the proportion of single bid tenders?

What is the average number of bids per tender?

What proportion of tenderers received an award?

What is the number of suppliers by particular items?

Is the market concentrated among a small number of suppliers?

But to answer those questions, you need to check that these key OCDS data fields are being published:

- tender/procurementMethod, to select tenders where competition is expected (open, selective or limited)

- tender/numberofTenderers & tender/tenderers/id, to know which firms or individuals submitted bids for a particular tender

- award/suppliers/id, to identify which tenderers won awards.

- tender/items/id, this can be useful to segment the analysis by markets, for instance, to analyze competition in construction works.

If the fields are available, then you are all set to start your analysis.

You can also study other interesting topics about procurement such as supplier participation (you might identify the top suppliers in the market and their success rates, for example), the efficiency of the process or the geographic distribution of contracts.

Do you have any other questions you would like to answer with OCDS data? Share your thoughts with us and check our future posts for new ideas!