COVID-19 data-driven monitoring in Ukraine: how much do masks cost?

This post is part of our ongoing content on COVID-19 emergency procurement. The civic procurement monitoring initiative DOZORRO and Transparency International Ukraine have analyzed the demand and prices of surgical masks in Ukraine over the first quarter of 2020, using ProZorro’s open contracting data and OCDS-based business intelligence tool. With a global shortage of masks, it is critical to keep prices transparent to avoid potential manipulation by procuring entities and speculation by suppliers. The Ukrainian approach is a great example of how the disclosure and use of open contracting data can help manage such risks.

Learn more about our recommendations for keeping emergency procurement open, fast, and smart, with data collection and disclosure, and read our guidance on using contracting data to monitor COVID-19 procurement.

On April 1, the Government of Ukraine introduced stricter measures to fight COVID-19. Among other restrictions, all people must wear a mask or respirator in public places.

There are different masks

There are several types of medical-grade masks being procured by Ukrainian authorities. A single-use surgical mask reduces transmission of the virus through exhaled droplets. It is usually a three-layer mask with a filter between two external layers of non-woven fabric.

There are also three types of respirator masks offering varying levels of protection: FFP1, FFP2, and FFP3. They are usually used by medical staff or the military working on the frontlines of the emergency response.

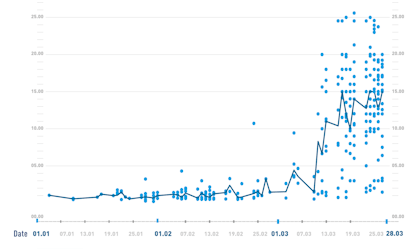

Mask prices in the ProZorro system

Nationwide quarantine measures and the rapid spread of COVID-19 in Ukraine have led to price gouging and shortages of goods that were not in high demand before the outbreak. Medical masks are up to twenty times more expensive than they were in January 2020. So how many medical masks have been purchased in 2020 via the country’s e-procurement system ProZorro and for what price?

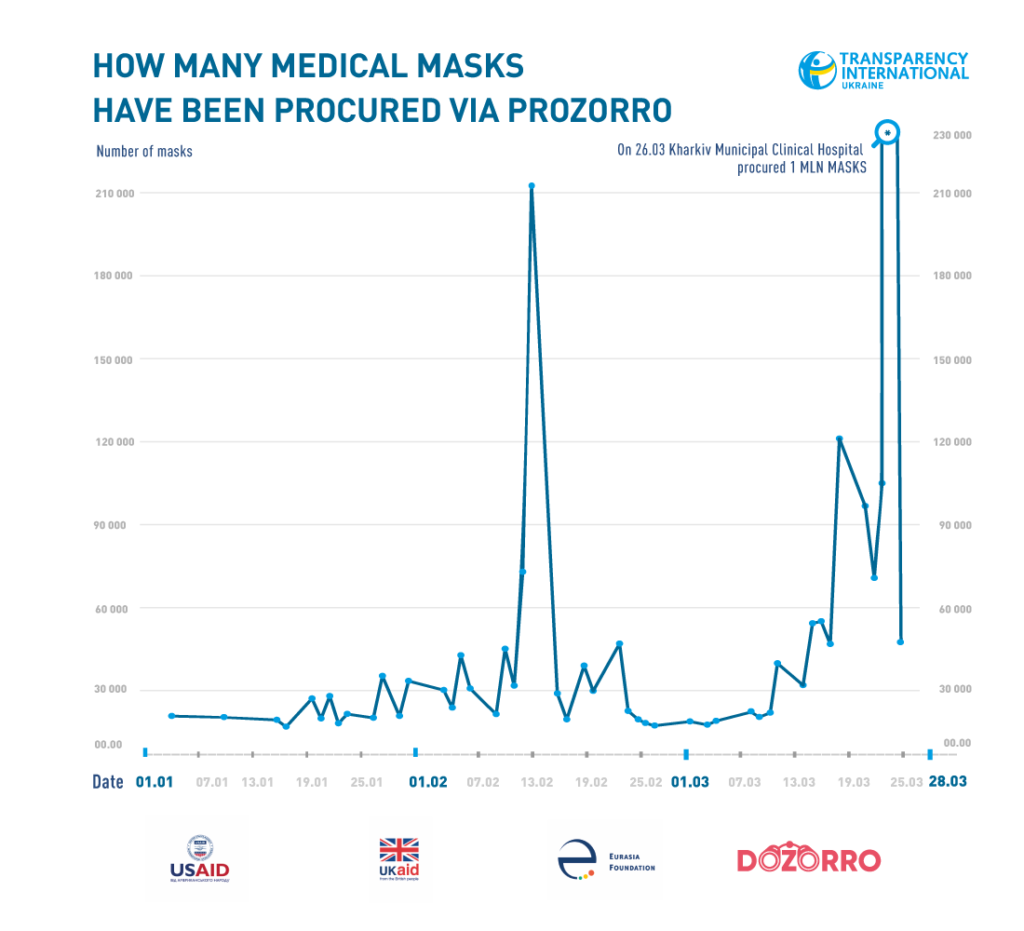

According to our calculations, public entities bought almost 2.5 million surgical masks for the total amount of UAH 25 million between January 1 and March 28, 2020 (± USD 1 million with an average exchange rate of 1 USD = 25 UAH). The month with the largest volume of purchases was March at 1.8 million masks. In February, entities bought 547,000 masks, and in January 108,000.

In mid-February, procuring entities started buying surgical masks more actively. For instance, on February 14, eight tenders were announced on ProZorro for the purchase of 228,000 units in total. Almost 90,000 units were purchased through direct agreements; the rest through open bidding.

The second peak of procurement happened on March 26, when over 1.1 million masks were purchased. One million of them were bought by Kharkiv Municipal Clinical Hospital No. 13 for UAH 14 million (± USD 560,000). The winning supplier, SOFI-MED LLC, must deliver them by April 30.

In January and February 2020, procuring entities mostly purchased surgical masks based on competitive bidding (below-threshold simplified competitive procurement, open tender). Most of them were successful and ended in the conclusion of agreements. In January 2020, suppliers bought surgical masks for UAH 0.68-1.5 on average, in February for UAH 0.7-3.2.

But in March 2020, 55% of competitive tenders were unsuccessful, meaning not a single participant made a bid. This means that there was a shortage of the product and/or that suppliers raised their prices. At the beginning of March, suppliers refused to sell medical masks for UAH 2-3 per unit, and in the middle of March, even UAH 7-12 per unit was not enough anymore. The average price jumped to UAH 10-25 per item.

For instance, ME ODESFARM supplied 1,000 surgical masks for UAH 24.5 per item to the Department of Municipal Property of Odessa City Council. SP Zheleznova O.V. supplied 2,000 masks for UAH 25.5 per item to the Territorial Directorate of the State Judicial Administration of Ukraine in Donetsk Oblast. SP Bastiuchenko O.V. supplied 5,000 masks for UAH 23 per item to the Center for Traffic Organization.

The rapid price increases and the big gap between the average and maximum price may indicate price gouging. Although definitive conclusions cannot be drawn from the data alone, scrutinizing the data provides critical insights to be investigated further.

On March 12, Deputy Minister of Healthcare Viktor Liashko said that the Anti-Monopoly Committee of Ukraine would check prices for personal protective equipment. By the end of the month, on 30 March, the Kyiv Oblast Territorial Division of the AMCU opened a case against manufacturers, suppliers and pharmacy chains in Kyiv and Kyiv Oblast due to the significant increase in mask prices.

It is interesting that one of the suppliers involved in the case sold masks to public procuring entities in March for the same price as in January and February 2020 – around 3 UAH per unit. In March, Tekhnokompleks LLC supplied 5,000 masks to Okhmatdyt children’s hospital for UAH 2.99 per unit, 3,600 masks for UAH 3 per unit to the Head Directorate of the National Police of Ukraine in Cherkasy Oblast, and 1,500 masks for UAH 2.96 per item to Kyiv Municipal Children’s Infectious Hospital. While in January and February these were some of the highest prices in the system, in March they were low relative to others.

Who are the top 5 suppliers of masks?

For the period January to March 2020, we can identify five leading vendors that earned the most and supplied the largest number of masks, accounting for 67% of the total spending and 48% of the total quantity. They are SOFI-MED LLC, TRANSPORT COMPANY AUTOLINE LLC, ODESFARM municipal enterprise, SP Polozhii Yevhen Oleksandrovych, and DIMAKS VBK LLC.

- The top supplier is SOFI-MED LLC, which sold one million medical masks for a total sum of UAH 14 million (that is, UAH 14 per unit) to Kharkiv Municipal Clinical Hospital No. 13. According to information provided by the analytical system YouControl, the primary activity of SOFI-MED LLC is wholesale trade in pharmaceutical goods.

Even though the company has existed for just over a year (it was registered on December 22, 2018), it actively participates in public procurement. From February 2019 to March 2020 inclusive, SOFI-MED LLC participated in 147 tenders, winning 61 tenders for a total amount of UAH 22.6 million. In 90% of the tenders, the goods supplied were medical supplies, equipment, and pharmaceutical items.

In December 2019, SOFI-MED LLC also sold 3,500 medical masks to L.T. Mala National Institute of Therapy for UAH 0.45 per item and supplied 15,000 masks Medicare to Balaklia Central Clinical Rayon Hospital for UAH 0.48 per item.

- The second largest supplier, with over UAH 1 million earned and 60,000 masks sold, is TRANSPORT COMPANY AUTOLINE LLC.

The main activity of the company is technical maintenance and repairs of motor vehicles. Unlike the top supplier, TRANSPORT COMPANY AUTOLINE was created eight years ago, but hasn’t been a very active participant in public procurement.

Between January 2018 and March 2020, the company participated in 55 tenders, with only nine of them competitive and the other 46 awarded through direct negotiations.

The main customer of TRANSPORT COMPANY AUTOLINE is the Odessa Municipal Electric Transport entity. The company entered into 38 agreements with this procuring entity, out of a total of 49 agreements concluded with any entity.

Before March 20 this year, the company specialized exclusively in car parts and car repair services in public procurement. But on March 20, TRANSPORT COMPANY AUTOLINE started supplying medical items, personal protective equipment, gloves and disinfectants. The company entered into 21 direct agreements for the supply of these goods, including 11 with the same Odessa Municipal Electric Transport entity. The company sold masks for UAH 17 and UAH 18 per item.

- The third-ranked company is ODESFARM municipal enterprise, which sold 53,000 masks for UAH 785,000 to various procuring entities. ODESFARM is a municipal enterprise of Odessa City Council, which engages in retail sales of pharmaceutical goods. It is an active player in public procurement. The enterprise has participated in 442 tenders, with 332 concluded agreements. Between March 16 and March 27, the company sold masks for UAH 17 to UAH 24.5 per item, i.e. the municipal enterprise sold masks for higher prices than private companies.

- The fourth place on the list of top mask suppliers belongs to Polozhii Yevhen Oleksandrovych – a sole proprietor, who won one tender in Prozorro and sold 40,000 masks to Kharkiv Heating Networks municipal enterprise for a total of UAH 600,000, that is, for UAH 15 per item.

The primary activity of Polozhii is wholesale trading in clothes and footwear, as well as production of leather clothes, work uniforms, etc. Before February 2017, Polozhii had engaged in wholesale trading in meat and meat products but had not participated in public procurement.

- The fifth largest supplier is DIMAKS VBK LLC. The company sold 21,500 masks to public entities for a total amount of UAH 366,000.

The company is quite young and has existed for only 1.5 years. It specializes in the construction of housing and non-residential buildings, electrical and other construction works.

DIMAKS VBK has participated in just four public tenders. In the first two, it supplied channels and pipes, in two others – medical masks for UAH 17 per item.

With the insights from open data on contracts and prices, we can monitor which procuring entities are purchasing which items, when and how. We can also monitor who wins these deals and all the anomalies in the system to keep our public spendings accountable. Based on similar research, the Anti-Monopoly Committee has already started its investigations. Moreover, such analytics and use of data (including our business intelligence tool) empowers procuring entities. It gives them an opportunity to better understand the market and plan their procurement purchases properly.