Learning Insights: 5 things stopping UK from achieving more impact

From the fall of Carillion to the profit warnings at Capita to falling spending with small businesses, all may not be well with public procurement in the UK. Assessing progress on the UK’s implementation of the Open Contracting Data Standard is all the more relevant. Has it happened? Is it helping reforms?

As background, the UK committed to being the first G7 member to implement the Open Contracting Data Standard as part of its commitments to fighting corruption and boosting local economic impact at the UK Anti-corruption Summit, in their Open Government Partnership National Action Plan (2016), and in the cross-government anti-corruption strategy (2017).

Though the UK’s political commitment was broad and ambitious, the Government took a targeted approach by applying it to Contracts Finder, a repository of UK tenders and contracts that is run by Crown Commercial Service (CCS). The project upgraded Contracts Finder data to machine-readable open data, aligned to Open Contracting Data Standard. Thought the benefit of this approach has been the improvement of a popular data feed, it has meant the UK has lost out on systemic procurement reforms in the awarding and monitoring of contracts.

The Crown Commercial Service recently published its first Monitoring, Evaluation, and Learning report on its open contracting project. In it, there is good news and bad news, and valuable lessons for other OCDS implementers.

The good news!

It is fair to say that the UK has made progress in improving the availability and usefulness of public procurement information.

When we started working with UK in 2016, there was limited data on Contracts Finder and few, if any, checks on data quality and the information available was far from a complete picture of government procurement. In the past year,112,619 notices have been published, the number of registered suppliers has increased by 52% with a majority being SMEs, and 275 new government buyers have started publishing on the platform. A new compliance strategy was implemented in June 2017 that includes monthly checks by the Crown Commercial Service Transparency in Procurement and quarterly reports on whether the data is being updated regularly in accordance with the regulations.

One of the most pressing issues affecting the usability of the dataset was the inability to publish identifiers such as company and charity numbers. In November 2017, this feature was added which resulted in a surge of identifiers. This was especially useful for the two data-thons organised by 360 Giving and OCP. You can read write-ups from the events here and here.

Crown Commercial Service also recognized the importance of multi-stakeholder and cross-governmental engagement in the project. They established a UK Open Contracting Steering group, comprised of UK government officials, civil society and data users, established to support delivery of the project.

In pursuit of their goal of SME participation, the UK team also began enabling key suppliers to advertise and report on sub-contractors in their supply chain. This makes the UK one of the first Open Contracting Data Standard implementers to a trial publication of subcontracting information. First data points from this feature should start rolling in from later this summer.

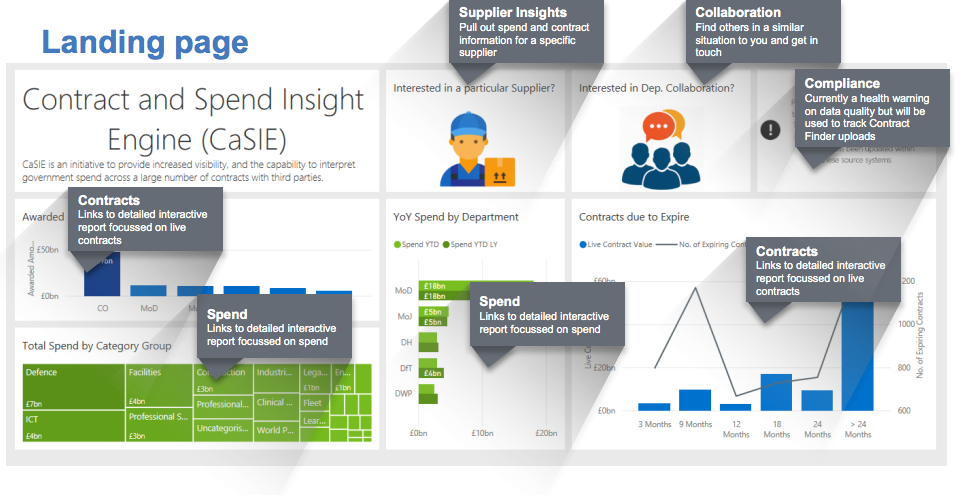

The team has also been exploring uses of the data to promote improved value for money. To this end, CaSIE, an internal tool for the Government which will provide powerful visualisations of key commercial data (including spending and contracts) has been developed by CCS. The objective is to help government buyers better manage supplier relationships.

The remaining challenges

Before proposing where the UK could do better, it’s important to highlight that Contracts Finder is not an e-procurement system but a reporting system. Each government department and local council use different systems to procure and publish tenders and contracts. They are required to report this information to multiple outlets (including the EU, Contracts Finder, local websites) according to various criteria set out in regulations. One of the unfortunate challenges that have not been addressed is that they don’t have to send the information to Contract Finder if they post it elsewhere. This leads to the unfortunate circumstance where the UK has the overhead, but not the functionality and added insight of a complete contracts register.

This shortcoming was very evident when Carillion imploded. There was a desperate scramble to assess the damage and Contracts Finder was not very helpful (covering less than 10% of the contracts by our estimation).

Technical change management is never easy in government, especially in countries like the UK where existing systems and organisational culture can create inertia to digital transformation. The work done by CCS in to break through some of these challenges is commendable.

Contracts Finder was established to advertise public sector procurements to SMEs and provide greater accountability to the taxpayer by providing transparency of contract opportunities and awards across the public sector. Accomplishing these goals will require significant further work.

Here are some of the areas in need of further work:

- Timeliness and completeness of reporting: While the MEL report shows some important improvements, there are still some major gaps in the timeliness and completeness of the planning, tender and award data published through Contracts Finder. For example, award notices are often published very late (up to a year after the fact) and many tender and award notices are missing from the platform altogether. Gaps of this size can significantly reduce the usefulness of this information, especially for businesses who are deciding whether to apply for bids or not. Departments need to do better in reporting the required information. This challenge is not unique to the UK as it involves both changing human behaviour as well as changing IT systems to facilitate timely and complete reporting. We are learning lessons about what kinds of carrots and sticks are helpful to this end such as highlighting good performers and chastising poor performers among their peers, making data entry more user-friendly and automated, validation and quality checks. We recommend to the UK to utilize all of these approaches to make timeliness and completeness of data published by the central government department a priority, assigning a department to oversee compliance.

- Completing the picture with bidding and post-award data: Presently, Contracts Finder is only enabling information on planning notices, tender notices and award notices. Certain key pieces of information for fulfilling the UK’s policy objectives are missing. For example, the identity and number of bidders in a procurement process is not published. To understand the procurement market and protect its integrity, this is critical information. In addition, contract documents themselves are rarely published. Without disclosure of contracts, citizens are left in the dark on deals that can affect their communities for decades. For example, in Gloucestershire, the local community has mounted a legal challenge to gain access to an incinerator contract and its amendments on the grounds that it may be both poor value for money and harmful to the environment. Despite access to information grounds for publishing the contract, the local council has fought disclosure. Reinforcing guidance, requirement and processes for the publication of draft and signed contract documents (except in prescribed circumstances of national security, public harm etc) would enable accountability. Finally, there is enormous value in publishing implementation data (such as payments and completion of milestones.) Late payment of contractors is a major issue in many parts of the world that leads to decreased participation of SMEs in procurement markets and decreased value for money (as prices go up and timelines extend). Linking and publishing this data can help ensure policy objectives of SME participation and government integrity and accountability.

- Lack of unique identifiers: In theory, if spend and procurement datasets (which are published separately) are compared, they should match. For each item of contract spending, there must be a corresponding contract. In practice, this is currently impossible to do in the UK. For both government spending and contract datasets, the lack of unique open identifiers for companies and buyers has been a consistent challenge. The UK Government has recognised this and has made some technical provisions to address this, which is encouraging. That said, the Government also announced a ‘data suppression law’ this year to help company directors, secretaries, people with significant control and LLP members remove home addresses from publicly available company documents. Addresses have long been used by civil society to investigate corruption and identify corporate networks, especially where unique identifiers are not available.

- New indicators: We believe the UK can boost its public procurement reform strategy by tracking the number of indicators that are not possible right now. These have been suggested to the Crown Commercial Services.

Data collection, publication & quality Data use & stakeholder engagement Impact indicators 1 Percent of contracts that have data across all five phases of contracting process for completeness of data 2 Total percent of procurement budget that is represented in Contracts Finder portal for completeness of data

3 Total percent of contracts that are submitted to Contracts Finder within x days of award (this “x” amount to be specified by local stakeholders) for timeliness

1 Number of unique bidders in Contracts Finder for Portal use 2 Number of unique SME bidders in Contracts Finder for Portal use/SMEs

3 Percent change of unique bidders in Contracts Finder over x time (this “x” period to be specified by local stakeholders), for Portal use

4 Percent change of unique SME bidders in Contracts Finder over x time (this “x” period to be specified by local stakeholders) for Portal use/SMEs 5 Percent of survey respondents who report they would recommend Contracts Finder for Portal quality

6 Percent of survey respondents who report they can find all the information they need on Contracts Finder for Portal quality

1 Mean number of tenders per supplier for Market Competitiveness 2 Average number of bidders per tender for Market Competitiveness

3 Percent of total awarded value awarded to recurring contractors for Market Competitiveness

4 Total percent savings (difference between budget and contract value) for VfM

5 Percent of contracts that exceed budget for VfM

- Lastly, more systemic reforms are needed for UK contracting. This is being hotly discussed in parliament and the National Audit Office and you can see our own commentary on this here.

The Open Government Partnership National Action Plan is the perfect opportunity for the UK to take on some of these recommendations and encourage the use of this data set by the government, civil society and business as well to help foster a culture of data in UK public procurement that is currently absent. Time is also ripe for the UK Government to encourage local councils and boroughs to use open contracting data to make cities smarter and fairer. We hope the moving of Crown Commercial Services to the Cabinet Office will improve coordination of this agenda across central and local government.

One more positive to end: the UK has been an active champion of open contracting globally through the Contracting 5, Open Government Partnership, Open Data Charter, the Anti-Corruption Summit, DFID and the Prosperity Fund. We are happy that the UK has prioritised public procurement transparency and hope it continues to push for quality and compliance. Lack of good quality information can damage trust in public procurement markets, deterring honest businesses from participating which can affect the diversity of suppliers, innovation and can make existing anti-corruption regime less effective. We look forward to seeing even more progress in the future.